What Is V5 INC RET PS? Simple Explanation for Everyone!

Have you seen v5 inc ret ps on your bank statement and wondered what it means? Don’t worry—this blog is here to help you understand it in the easiest way possible. Whether you’re just learning about money or you’ve been banking for years, this strange code can be confusing. But once you know what it stands for, things become a lot clearer.

The v5 inc ret ps code is something many TD Bank users come across, and it usually shows up when there’s a problem with a cheque. Imagine this: someone gives you a cheque, you happily deposit it, but then you notice your money didn’t stay in your account. Instead, you see this scary-looking code. What happened? This code means the cheque “bounced.” That’s a fancy way of saying it didn’t go through. Maybe the person who gave it to you didn’t have enough money in their account, or there was a mistake on the cheque.

What Does V5 INC RET PS Mean on a TD Bank Statement?

When you see v5 inc ret ps on your TD Bank statement, it usually means a cheque you put into your account did not go through. This is a code the bank uses to tell you something went wrong. The cheque was supposed to give you money, but it was sent back. It’s like when someone promises to give you money but then takes it back before it arrives. TD Bank uses this code to help tell you what happened. It may be confusing at first, but it’s not always a bad thing. It’s just the bank’s way of saying there’s a problem with the cheque you received. You’ll need to check why it didn’t work.

Why You Might See V5 INC RET PS After Depositing a Cheque

You might see v5 inc ret ps on your statement after you deposit a cheque if there’s a problem with that cheque. Maybe the person who gave you the cheque didn’t have enough money in their account. Or maybe there was a mistake on the cheque, like wrong numbers or names. Sometimes the bank scanner has trouble reading the cheque. These small problems can make a cheque “bounce,” which means the money never makes it to your account. It’s like trying to fill a water bottle from a tap, but the tap is dry. The bank uses this code to tell you something stopped the money from coming in.

Common Reasons Behind V5 INC RET PS Issues

There are many reasons why v5 inc ret ps might show up in your account. A very common reason is not enough money in the sender’s bank account. Another reason is the cheque was filled out wrong—maybe the numbers didn’t match, or something was missing. Sometimes, the person who wrote the cheque changes their mind and asks the bank to stop the payment. Or there could be a printing error on the cheque that makes it unreadable. Even a small thing, like writing outside the lines, can confuse the bank system. These issues make the cheque fail, and the bank tells you using this code.

What to Do When You See V5 INC RET PS in Your Account

If you see v5 inc ret ps in your TD account, don’t panic. First, call TD Bank or visit a nearby branch. Ask them to explain what happened with the cheque. They will tell you if the cheque bounced and why. Then, contact the person who gave you the cheque. Ask them nicely if they can check with their bank and maybe send a new cheque or pay another way. You can also ask TD Bank if you were charged any fees. Keep notes of who you talked to and what they said. This helps you stay organized and fix the problem faster.

How to Talk to the Bank About a V5 INC RET PS Problem

Talking to the bank about v5 inc ret ps can feel scary, but it’s easy when you know what to say. You can call TD Bank or go in person. Say, “I saw a code v5 inc ret ps in my account. Can you help me understand what it means?” Ask if the cheque bounced and if any money was taken back. You can also ask if they charged a fee and how you can avoid it next time. Write down what they tell you. If you feel confused, ask again until you understand. Bank workers are there to help, so don’t be afraid to speak up.

When a Cheque Bounces: What V5 INC RET PS Is Really Telling You

The v5 inc ret ps message is really the bank’s way of saying a cheque didn’t work. A bounced cheque means the money was not sent to your account, even if it looked like it was. The bank saw a problem and had to return the cheque. This message is just a short way of explaining that. Think of it like a red light—it’s there to stop something from going the wrong way. If you see this message, it’s time to find out what went wrong so you can fix it. It doesn’t always mean someone did something wrong—it just means there’s a money issue.

Is It Your Fault? Understanding Who’s Responsible for V5 INC RET PS

Most of the time, v5 inc ret ps is not your fault. If you are the person who got the cheque, then you were just trying to put it in your account. The problem usually starts with the person who gave you the cheque. Maybe their account didn’t have enough money, or maybe they made a mistake when writing the cheque. But banks sometimes close accounts if they think something looks unsafe. If that happens, you can ask them to explain why. Always stay calm, and don’t blame yourself too fast. This code just means there’s something to check out before you try again.

Can V5 INC RET PS Affect Your Bank Account?

Yes, v5 inc ret ps can sometimes affect your account, but not always in a big way. If the cheque was for a lot of money and you already used some of it, the bank might get worried and close or freeze your account. This doesn’t happen to everyone, but it’s possible. It depends on how much money was involved and if the bank thinks something looks risky. That’s why it’s good to wait until a cheque is fully cleared before spending the money. If your account gets closed, talk to the bank and ask how to get your money back or open a new account.

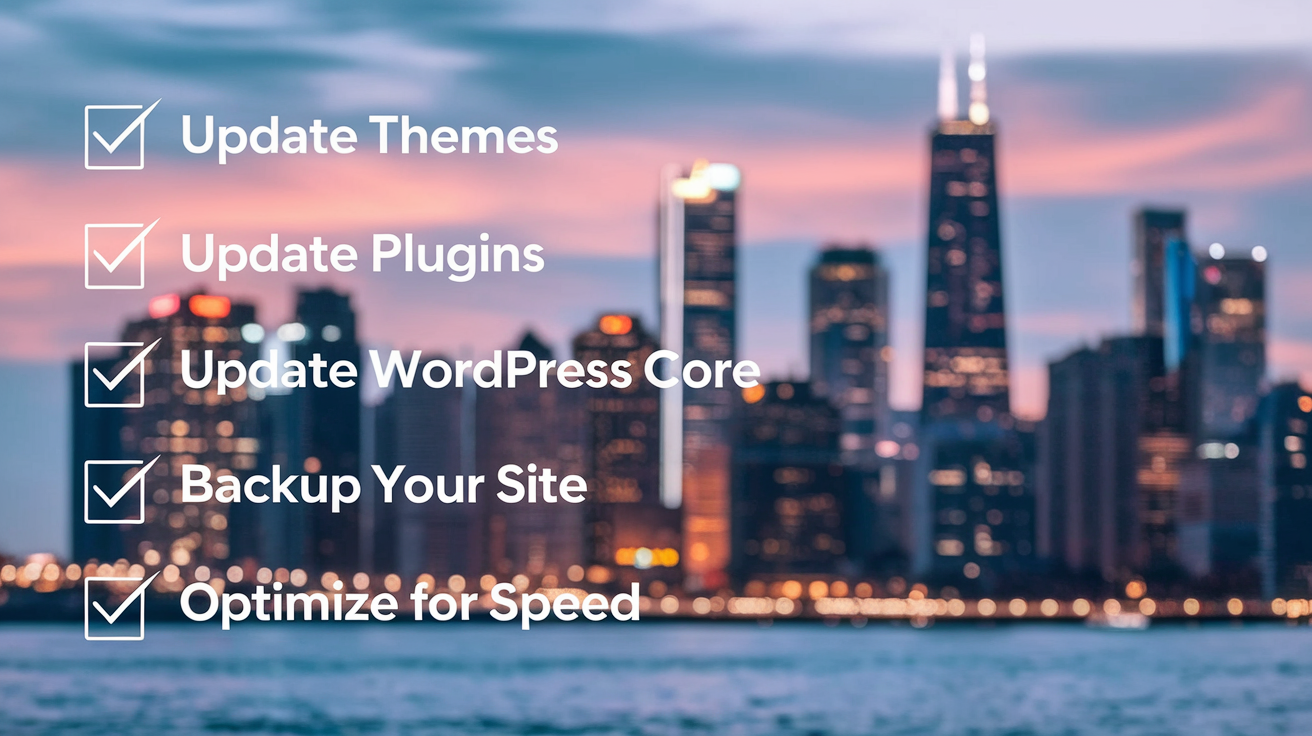

How to Avoid Seeing V5 INC RET PS Again

To avoid v5 inc ret ps in the future, try a few simple things. First, only accept cheques from people or companies you trust. If someone gives you a big cheque, ask them to double-check their bank balance first. You can also wait until the cheque fully clears before spending the money. It’s smart to deposit cheques in person instead of through a photo app—this helps reduce errors. Always make sure names and numbers are written clearly. If something looks wrong on the cheque, ask for a new one before you deposit it. These steps help keep your money safe and avoid problems.

Legal Help for V5 INC RET PS: When You Might Need a Lawyer

Sometimes, v5 inc ret ps can turn into a bigger problem—like if someone refuses to pay you after their cheque bounces. If the amount is big or your account is frozen, you might want to talk to a lawyer. A lawyer can help you ask for your money back in a legal way. They can also help if the person who gave you the cheque is being unfair or difficult. You don’t always need a lawyer, but it’s good to ask one if the problem doesn’t go away. This can help protect your money and your business, especially if it’s a lot of money.

Conclusion

Now you know what v5 inc ret ps means and what to do when it shows up. This code just means a cheque didn’t go through. It’s not your fault. Sometimes banks use confusing words, but now it’s easier to understand. If you see this message, talk to your bank and the person who gave you the cheque.

Don’t feel scared. You’re not alone. Many people deal with bounced cheques. Stay calm, ask for help, and try to fix the issue step by step. Next time, you’ll be even smarter when it comes to cheques and banking.

FAQs

Q: What does v5 inc ret ps mean?

A: It means a cheque you deposited was returned or bounced by the bank.

Q: Is v5 inc ret ps my fault?

A: No, it’s usually the fault of the person who gave you the cheque.

Q: Can I get my money back after seeing v5 inc ret ps?

A: Only if the sender gives you a new cheque or pays another way.

Q: Should I call the bank about v5 inc ret ps?

A: Yes, they can explain what happened and guide you on what to do next.

Q: Can I stop this from happening again?

A: Yes, only accept cheques from trusted people and wait for them to fully clear.